NO more special tax relief of RM2000 ONLY available for YA2013. For the first child a working mother may claim 15 of the total income earned.

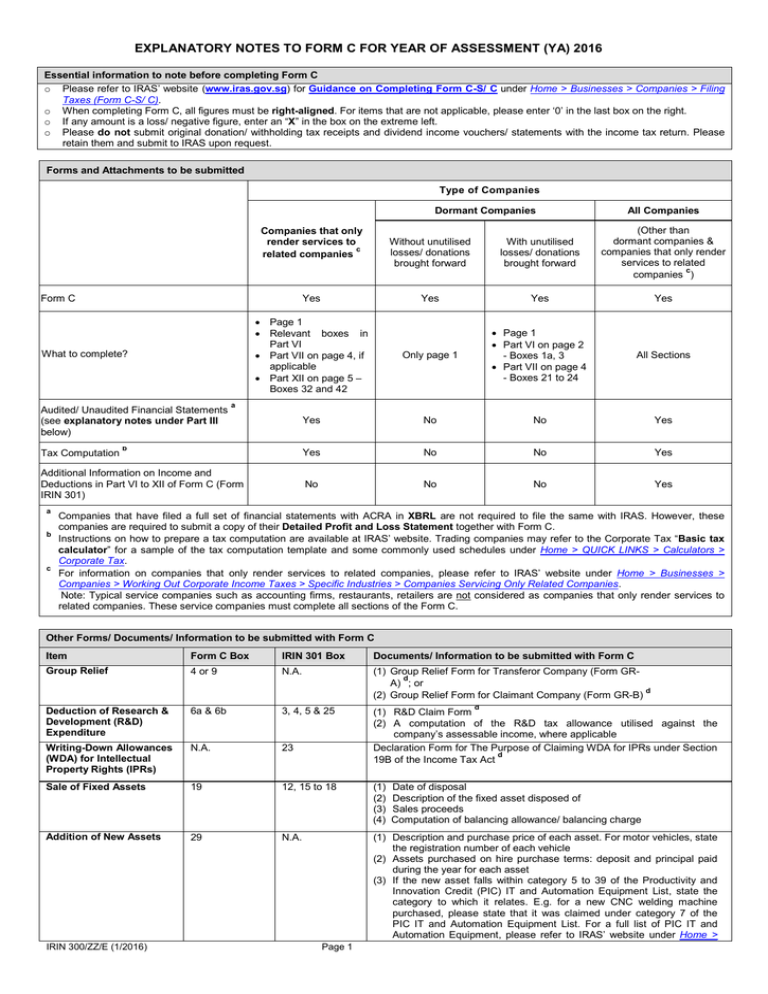

Explanatory Notes To Form C For Year Of Assessment Ya 2016

For the second child 20 of earned income is eligible for tax relief.

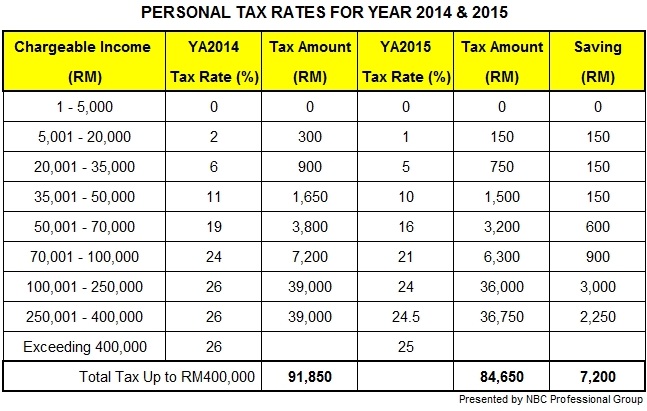

Personal tax relief for ya2014. For the Year of Assessment 2018 the personal tax relief below is applicable to me. Tax tax relief YA2014. Currently personal tax relief of up to MYR 1000 is given to resident individuals for the following domestic travel expenses incurred from 1 March 2020 to 31 August 2020.

Coming to the last weekend of personal income tax e-filing if without any extension period here is the updated list of various tax relief granted for your reference. Personal Income Tax Relief Cap. Taxation for Non- Residents Employment Income.

Finance Malaysia Blogspot Personal Tax Relief For Ya2014. Personal Tax Relief for YA2014. Otherwise it will be reduced by the relief and the balance is taxed at the standard rate of 20.

Not much changes from YA2013 except on the following items. Coming to the last weekend of personal income tax e-filing if without any extension period here is the updated list of various tax relief granted for your reference. I accommodation expenses at premises registered with the Ministry of Tourism Arts and Culture Malaysia.

Under the Budget 2014 proposals taxpayers who are under employment may not need to file their personal tax returns from the Year of Assessment YA 2014 onwards rendering the amount of monthly tax deduction as the final tax. 1280 per month to Kshs 16896 per annum Kshs. Personal Tax Relief for YA2014 April 25 2015 Get link.

For the third and subsequent children 25 of earned income is eligible for tax relief. Use myAccount to apply for these tax reliefs by selecting the icon. The Resident Personal Relief has been increased from Kshs.

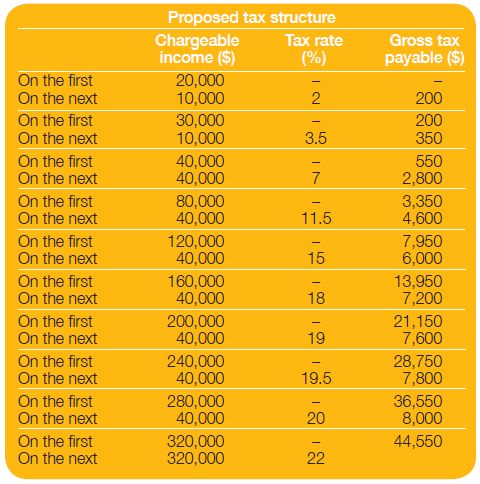

A personal income tax relief cap of 80000 applies to the total amount of all tax reliefs claimed for each Year of Assessment. Actually I had been working on my income tax assessment since November 2018 including an estimation of my personal tax relief. You should continue to claim the personal reliefs if you have met the qualifying conditions.

If you pay tax at the higher rate of 40 your income is reduced by the relief and the balance is taxed at 40. So if you bought a computer that costs more than that you can no longer include your gym membership internet subscription and others for income tax relief. Not much changes from YA2013 except on the following items.

Not much changes from YA2013 except on the following items. 1408 per month Employers employees and other individual taxpayers are advised to implement the above changes while computing the taxes for periods beginning 1st January 2018. Personal Tax Reliefs in Malaysia.

Posted on January 6 2014by Richard Leave a reply. April 25 2015 Coming to the last weekend of personal income tax e-filing if without any extension period here is the updated list of various tax relief granted for your reference. My estimated 2018 personal tax relief.

Personal Tax Relief for YA2014 Coming to the last weekend of personal income tax e-filing if without any extension period here is the updated list of various tax relief granted for your reference. Not much changes from YA2013 except on the following items. The conditions of entitlement for each relief must be satisfied in order to minimize the income tax liability.

Do also take note. We would like to look at some of the reliefs that may be overlooked when we file our taxes. Individual personal tax relief is only available for individuals who are considered tax resident in Malaysia.

The maximum income tax relief amount for the lifestyle category is RM2500. The amount of relief you receive depends on the rate of tax you pay. Together with like-minded Singaporeans at the Personal Finance Discussion SG Facebook Group by discussing a range of personal finance topics.

Personal Tax Relief for YA2014 April 25 2015 Coming to the last weekend of personal income tax e-filing if without any extension period here is the updated list of various tax relief. The Gobear Complete Guide To Lhdn Income Tax Reliefs Gobear Malaysia. Any amount paid to Non-Resident individuals in respect of any employment with or services rendered to an employer who is resident in Kenya or to a permanent establishment in Kenya is subject to income tax charged at the prevailing individual income tax rates.

Ii entrance fees to tourist attractions these are yet to. 28800 per annum Kshs. Tax Relief For Companies That Pay Off Employees Ptptn Loans Borneo Post Online.

Everything You Should Claim As Income Tax Relief Malaysia 2020 Ya 2019. Reliefs are available to an individual who is a tax resident in Malaysia in that particular YA to reduce the chargeable income and tax liability. The percentage of tax rebate can also be added up to a maximum of 100.

Coming to the last weekend of personal income tax e-filing if without any extension period here is the updated list of various tax relief granted for your reference. No tax relief is available for non-tax residents. Here S How To Maximise Your Education Income Tax Relief.

Before we move on further do take note the amount shared below is just an estimated figure. Personal Relief of Kshs. Generally rule is a person is a Malaysia tax resident if heshe stays more than 180 days in Malaysia.

Not much changes from YA2013 except on the following items. Monthly Tax Deduction as Final Tax. 15360 per annum Kshs.

Personal Tax Relief for YA2014. Companies are not entitled to reliefs and rebates. For YA2014 the deadlines for filing taxes are 15 Apr 2014 by paper form and 18 Apr 2014 by e.

There are some other rules a person can be qualified as tax resident in Malaysia.

Enhancing The Double Tax Deduction For Internationalisation Scheme 1 April March 2016 1 Background Pdf Free Download

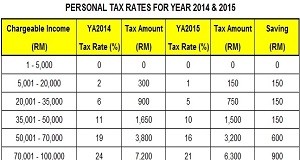

Budget 2015 New Personal Tax Rates For Individuals Ya2015 Tax Updates Budget Business News

Singapore Budget 2015 Individual Tax Tax Singapore

15 Tax Deductions You Should Know E Filing Guidance Financetwitter

4 Tips To Help Keep You On Correct Path To Income Tax Filing Tax Updates Budget Business News

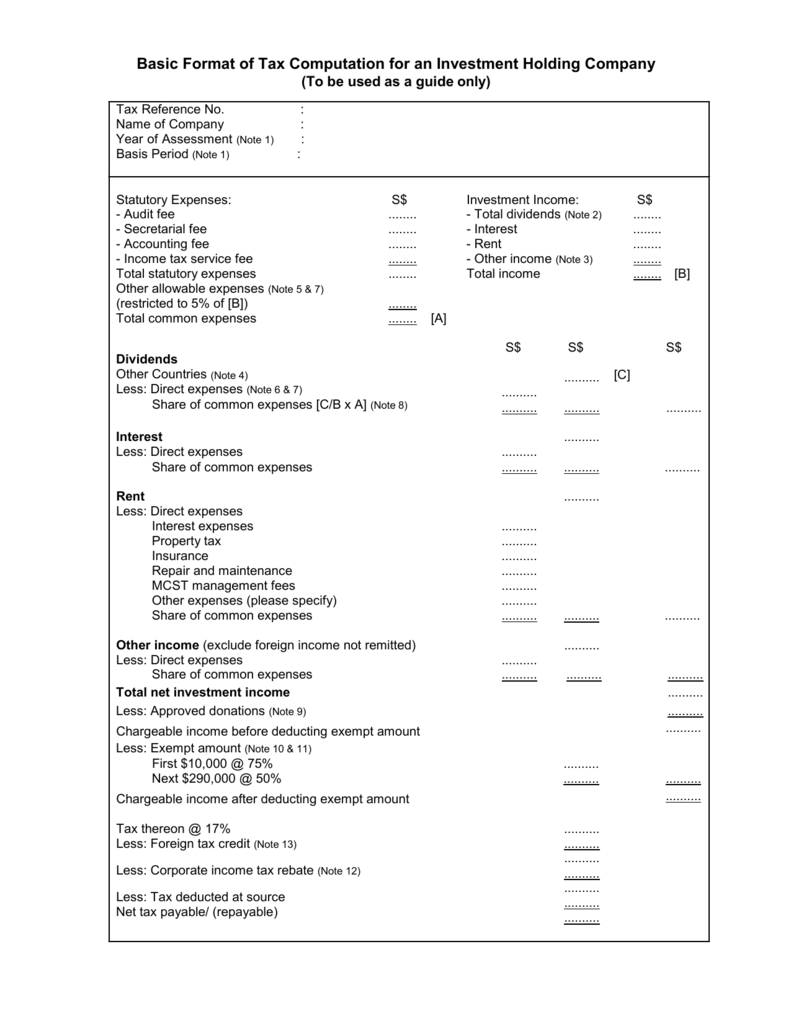

Basic Format Of Tax Computation For An Investment Holding Company

15 Tax Deductions You Should Know E Filing Guidance Financetwitter

Finance Malaysia Blogspot Personal Tax Relief For Ya2014

Https Ancgroup Biz Wp Content Uploads 2021 03 Individual Tax Handbook 2020 2021 Pdf

Tutorial 1 And 2 Cia 2005 Individual Income Tax Tutorial 1 Tutorial 2 1 What Is Tax Explain The Characteristics Of Tax 2 How Do Tax Payments Course Hero

Guidelines On Tax Treatment Related To The Implementation Of Mfrs 121 Or Other Similar Standards Pdf Free Download

Acura Tl 2012 8500 Hialeah Negocialo Ya Acura Tl Acura Hialeah

Personal Tax Archives Tax Updates Budget Business News

Job In Income Tax Department On Contract Basis Job Retro

15 Tax Deductions You Should Know E Filing Guidance Financetwitter

Question 3 5 Needs Help To Be Answeredquestion Chegg Com

Finance Malaysia Blogspot Personal Tax Relief For Ya2014

Apple Announced Ios 8 With Many New Features Including Big Announcements About Mac Os X Yosemite And A New Programming Language Called Swi Ios 8 Apple Pay Sms