Demand for gold as an asset has been consistent and robust buoyed by diverse segments such as. But in addition to golds tactical benefits its function as a core.

Asset Allocation The Ultimate Guide For 2021

Gold belongs to the Commodites Asset Class Other commodities.

Why gold is different asset class. Some use it as a store of wealth and as an inflation and currency hedge. Gold is somewhat of an odd asset thanks to its history. Fixed Income Bond Terms Definitions for the most common bond and fixed income terms.

Gold as a Strategic Asset Class. Gold has nothing in common with equities either. Paper gold and physical gold.

It employs no staff no board of directors and gives no. Theres a big difference between gold Bitcoin and almost all other cryptos. Many investors are drawn to golds role as a diversifier due to its low correlation to most mainstream assets and as a hedge against systemic risk and strong stock market pullbacks.

Over the last decade gold investments were one of the best performing asset classes. Gold as an Asset Class. Marc and The Oxford Club advocate that 5 of your portfolio go toward speculative assets like crypto Crypto not Bitcoin.

Gold mining output is relatively flat - it takes yearsdecades to increase it in times of high demand. A Different Asset Class Bonds. And in the US this figure is close to 30.

Exchange five bottles of port for two bolts of wool and both sides are better off. Investing in several different asset classes ensures a certain amount of diversity in investment selections. Central banks which.

Historically gold has been a symbol of wealth and always in great demand. Gold frequently traded with futures or options is a financial derivative. Fiat Money Real goods and services have use value.

The probability of one asset class or a single investment significantly dropping in value is far higher than the chances that a well balanced portfolio of many different investments from various asset classes will depreciate in value significantly. Gold does well when investors lose confidence in the future returns offered by stocks corporate bonds other paper assets. Gold outperforms other asset classes in the long run giving positive returns consistently across various market conditions.

Each different currency represented a. Unlike other commodities or asset classes gold is available for investment in two forms. An asset class is a group of securities that exhibits similar characteristics behaves similarly in the marketplace and is subject to the same laws and regulations.

The allocation in Manwards Modern Asset Portfolio doesnt call for a big stake in Bitcoin. The Sumerians invented warehouse receipts. What is an Asset Class.

An asset class is a group of similar investment vehicles. Different classes or types of investment assets such as fixed-income investments. 35 gain during 2000 - 2003 rate cut cycle.

The asset class also determines how items are regulated. Any investment in gold is subject to changes in different factors including the dollar value the demand from international banks and industries. Nor is gold.

Examples of items include investment options like gold art or real estate. Gold May Be the Best Asset Class in 2020. Gold pays you no interest not unless you lend it in return for a yield rather than lend it in ignorance via an.

Gold Gold is a precious metal and has a store of value Gold is a good hedge against inflation You can hold gold in physical as well as non-physical form. Different asset classes have different cash flows streams and varying degrees of risk. Method of describing and categorizing items exchanged in the marketplace.

International developed-country bonds are often considered a defensive asset class that offers US-based investors geographic and currency diversification benefits along with income potential. The added geopolitical tensions in the Middle East add yet another reason to keep gold exposure in your portfolio in 2020. It would probably be generous to say that even 1 of American investors have an adequate understanding of why at least a 10 portion of their assets should be safeguarded in gold and silver primarily in bullion.

It was used as a currency even when coins of silver or bronze were in circulation. As we listen to the gaggle of former central bankers in recent months now admitting that monetary policy is less effective and. It turns out that ALL money is fiat.

Instead of carrying around jars. Theres a big difference. Categories are determined by physical characteristics and similar performance on the market.

It calls for a 10 stake in crypto. For much of the history of money gold was the determining factor in the value of currencies. Gold and other precious metals can be used to help buffer a portfolio against inflation and market shocks.

It has been almost three decades since Wall Street and the media have considered gold as an asset class. Annuity perpetuity coupon rate covariance current yield par value yield to maturity. Investors have often used gold tactically in their portfolios with an aim to help preserve wealth with a relatively liquid asset that can potentially help navigate risk during market corrections geopolitical stress or persistent dollar weakness.

Silver Copper. Tends to do well when the Fed is cutting rates. Jan 06 2020 by Larry Berman in Markets Views Analysis.

Importance Of Asset Allocation Evolution Of Asset Allocation From Piggy Banks Edelweiss Mf

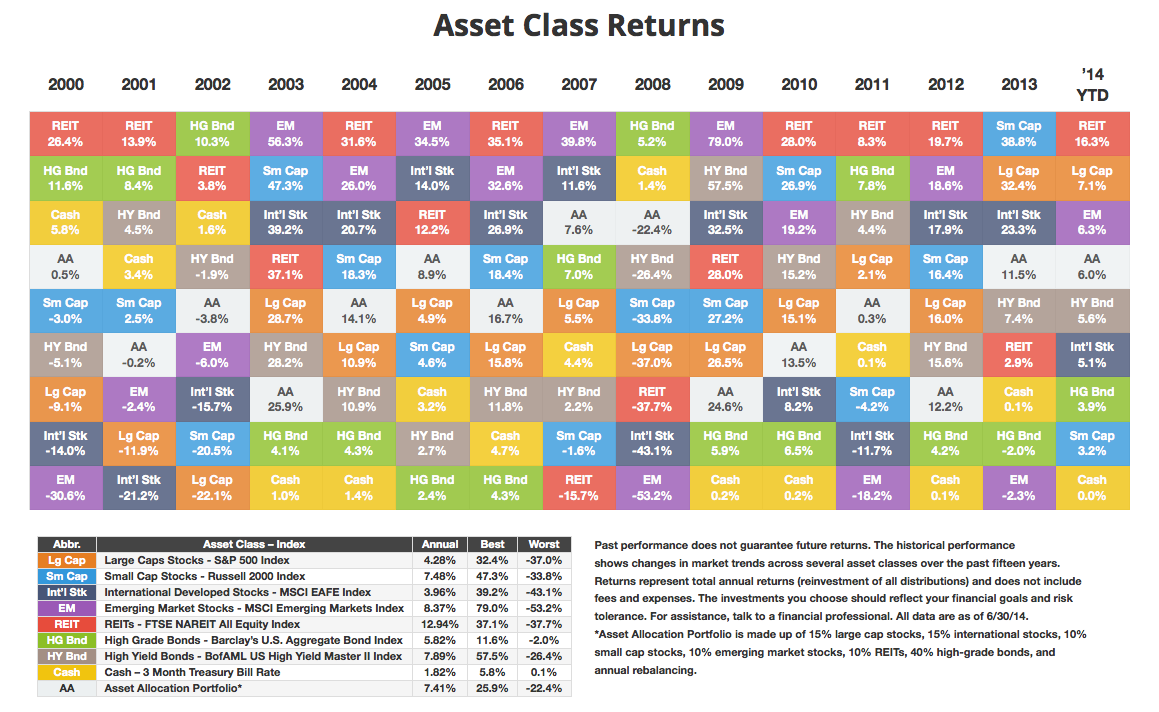

Investing 101 Asset Class Returns Since 2000 And A Refresher On Active Vs Passive Investing Seeking Alpha

How Does Gold Compare To Other Asset Classes My Gold Guide

How Does Gold Compare To Other Asset Classes My Gold Guide

The Birth Of A New Asset Class Crypto Assets Part I Retail Investors Love Magic Beans Class Investors Asset

How Every Asset Class Currency And Sector Performed In 2018 Infographic Marketing Corporate Bonds Asset

Super Informative Post On The 5 Main Asset Classes For Investment Such A Great Personal Finance Read For Anyone Who Investing Finance Saving Money Management

The Role Of Gold As A Asset Class For The Private Wealth Industry Singapore Bullion Market Association

5 Reasons Why Asset Allocation Is Important For Your Financial Goals

S Should I Buy Stocks Bonds Etfs Properties Gold Or Unit Trusts Etc Which Asset Class Makes The Best Investment I Investing Best Investments Stock Market

Annualized Returns By Asset Class From 1999 To 2018 Financial Samurai Investing Best Investments Asset Management

5 Reasons Why Asset Allocation Is Important For Your Financial Goals

April Performance For The Different Asset Classes Corporate Bonds Asset Chart

A Made In India Asset Allocation

How Does Gold Compare To Other Asset Classes My Gold Guide

How Does Gold Compare To Other Asset Classes My Gold Guide

Asset Allocation The Ultimate Guide For 2021

Asset Class Overview And Different Types Of Asset Classes

Asset Class Definition Types Of Asset Classes Franklin Templeton