Working with Prium will save you money time and insure you full compliance. Effective tax planning can be critical to helping government contractors moderate tax liability and optimize profits in a highly competitive landscape.

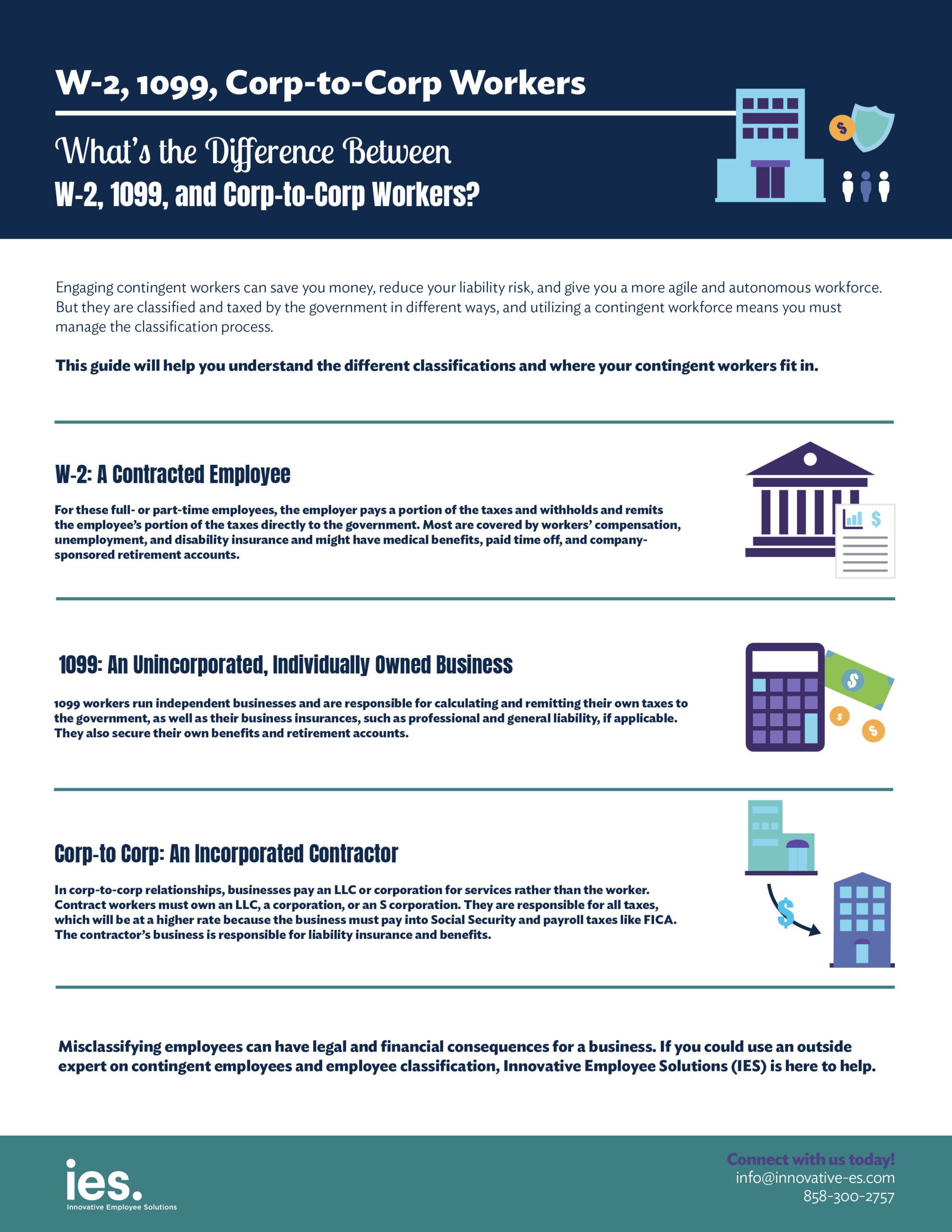

What S The Difference Between W 2 1099 And Corp To Corp Workers

Tax compliance isnt for the faint of heart these days.

Tax compliance and contracting most. However while compliance monitoring is necessary it is essential that there are processes which allow insight to the need or. In the face of these concerns as well as ever-changing tax laws and regulations and shortages of tax talent the important business of compliance. Working with a Portage salarial Company is the simplest and most secure way for an international company to employ contractors in France especially if they dont have a local entity in France.

Based on my calculations at least 7 0 percent of the total cost of federal tax compliance is due to the income tax indicating that businesses will pay an estimated 925 billion in 1994 to comply with the federal income tax. Any intent to withhold or enter fraudulent information may result in prosecution to the fullest extent of the law and re-evaluation of tax compliance resulting in the potential loss of opportunities within the City of Philadelphia. Contact us by email.

Overall tax compliance involves being aware of and observing the state federal and international tax laws and requirements set forth by government officials and other taxing authorities. Visit us at our offices on the Second Floor of. Below is a list of University policies and resources related to contracting.

According to the most authoritative source tax compliance costs are defined as those costs. Academic program agreements are contracts between the University and another institution or organization to establish a joint educational program a collaborative academic relationship such as a student exchange or a research activity unrelated to sponsored research. Its primary duties are to ensure UVAs compliance with all the various tax laws and to manage contracting activities for UVAs central administration and operational units.

Policy on University-Related Foundations. As an international contractor tax compliance is difficult at the best of times. Acceptance Receipt and Acknowledgment of Gifts.

Social versus Taxpayer Compliance Costs The term tax compliance cost is ca-pable of different interpretations. Our international tax professionals work seamlessly across borders with their counterparts around the world to help you avoid significant penalties for noncompliance and maintain the most tax-favored position. Call us at 434-924-4024 or 434-243-5592.

The most interesting office you may have never heard of Bill Define Director of Tax Compliance and Contracting will be the first to admit that the name of his office sounds a bit dry and technical and perhaps not the most exciting position at UVA. The Office of Tax Compliance and Contracting is located within the Financial Operations area of UVAFinance. Historically about two-thirds of the compliance burden or 1322 billion is borne by the business sector.

These requirements are described. Taxpayer Name Account Number Entity ID Property Address if applicable and Compliance. Contracts Signed through the Provosts Office.

Any person or business thats run into trouble with the IRS or had their tax return denied or audited can confirm the critical importance of tax compliance. Proper execution can directly affect cash flow the defensibility of tax return positions risk management and ultimately the publics perception of your company as a responsible taxpayer. Federal and state income taxes are complex and many organizations must address the additional complexities of local and foreign tax regulations.

A con-sensus as to the precise meaning and mea-surement of compliance costs only began to emerge in the literature about 25 years ago. What is Tax Compliance. Retail sales by manufacturercontractors are subject to sales tax on the full sales price.

As I will specifically address in my testimony GSA has participated with the US. Tax compliance work goes hand in hand with other tax advisory services to bring you a comprehensive approach to international tax planning. All emails should include.

But during a global pandemic with different countries in varying stages of lockdown and authorities taking steps to amend and update legislation to ensure its relevant with the current climate staying on top of the changes that are relevant to your individual situation is to put it bluntly almost impossible without. Tax Compliance and Contracting. A basic example here is the annual April deadline for tax return.

Questions about a Contract or the Contracting Process. The use tax obligation of a manufacturercontractor depends on whether it maintains an inventory of its products for sale to others or makes its product available for sale to others through a publication or price list. It is an important area of business performance which in theory will raise efficiency and reduce risks.

These agreements are processed and signed by the Provosts Office in. To speak with someone about your compliance status please call 215 686-6565 or email taxclearancephilagov. Beyond timely accurate compliance services.

Contract compliance management can embrace many different aspects and phases of contract management. Academic Approval and Signatory Authority for. Department of the Treasury in the Federal Contractor Tax Compliance Task Force to identity several key automated systems changes that have enhanced the accuracy of the information that we presently have regarding Federal contractors.

September 21 2017. In laymans terms the offices duties fall in three big buckets. Contract Policies and Resources.

Construction Accounting Methods For Financial Reporting And Income Tax Reporting

What S The Difference Between W 2 1099 And Corp To Corp Workers

Sara Hansard On Twitter Payroll Taxes Payroll Tax Refund

Pin Oleh Jean Pierre Riviere Di Business Model

Safety Helmets Are Replacing Hard Hats On Construction Sites Bloomberg Bna Construction Safety Safety Helmet Hard Hats

Cost Saving Tax Strategies For Real Estate Developers

Working For A Foreign Employer Here S How To Report It On A Tax Return

Contract And Commercial Management Survey Deloitte Us

Doing Business In The United States Federal Tax Issues Pwc

Overview Of Annotations File Cabinet Cs Annotation Quickbooks Tax Software

Pin On Law Books For Aspiring Lawyers To Improve Their Legal Skills

The Burden Of Accounting And Taxes On Small Business Small Business Accounting Small Business Management Business Tax

Construction Accounting For Contractors Full Guide Financepal

Should I Be A Contractor Or Employee A Guide For Remote Workers

State Local Tax Compliance Government Contractors Virginia Cpa

Construction Accounting For Contractors Full Guide Financepal

Pin On Contract Management Software