This sub-fund is fully invested in Singapore equities. Singapore funds and fund management recent developments.

How Softbank S 100b Fund Is In A League All Its Own Fund League Comcast

Launched in September 2006 the SGD 901m 635m fund is managed by Citywire A-rated Tim Bachmann.

New fund public singapore equity fund. Public Singapore Equity Fund Singapore is into a new era now after opening its door to casinos which attracted massive foreign direct investments. State Street Global Advisors Singapore. The sub-fund is denominated in Singapore Dollars.

The Monetary Authority of Singapore MAS Asset Management Annual Survey reported in October 2016 that globally assets under management AUM grew just 1 percent to US714 trillion weighed down by slower growth in emerging markets and fears of monetary policy normalisation in the US. The small little island poised to grow further boosted by various industry not only gaming. The funds we mandate invest at least 50 of their committed capital into Singapore companies.

7 June 2011. The small little island poised to grow further boosted by various industry not only gaming. The objective of this sub-fund is to achieve long-term capital appreciation by investing in a portfolio of Singapore equities.

Local investment funds are beyond the scope of this article which will focus on offshore investment funds and in particular the methods by which offshore investment funds may be marketed in Singapore. Stock funds in Singapore. The new fund brings Lead Edges total capital under management to over US3 billion.

LBO funds may list as an investment fund on the Singapore Exchange Securities Trading Limited which is the only approved equities securities exchange in Singapore. To achieve capital growth over the medium to long-term period by investing in a portfolio of investments primarily in the Singapore market. UPDATED Tue Oct 02 2018 - 400 PM.

A GIP fund must invest at least 50 of its total funds raised in Singapore-based companies in. A GIP fund must raise capital from GIP applicants from at least 2 or more countries with minimum 15 of GIP applicants coming from one or more secondary markets. 15 billion units.

Public Singapore Equity Fund Singapore is into a new era now after opening its door to casinos which attracted massive foreign direct investments. About 70per cent of the firms fund comes from wealthy individuals who include executives entrepreneurs and. Under Singapore law there are three methods of offering shares or interests in Singapore namely.

The Fund seeks to achieve capital growth over the medium to long-term period by investing in up to a maximum of 30 stocks in the Singapore market including Singapore stocks listed in other markets. Public Singapore Equity Fund. Approved Fund Size.

Stock funds are also known as equity funds in SingaporeEquity funds are mutual funds allowing an investor to purchase ownership in a Singapore company. Equity stocks also allow local and foreign investors to purchase stocks within a fund easier than purchasing securitiesSingapore equity funds may be divided into several categories. By way of a public offering.

Fullerton Fund Management Company Ltd. NTUC Income Insurance Co-operative Limited. The fund is registered for sale in Singapore.

Category of Fund. For more information on our fund commitments please click here. The fund may also consider investments in unlisted equities particularly in companies that are expected to seek listing on the Singapore domestic and global markets within timeframe of two years.

The funds investment in the domestic and global markets is incidental to its primary focus of investing in the Singapore market. Tue Oct 02 2018 - 550 AM. Public Singapore Equity Fund is an open-end unit trust incorporated in Malaysia.

New framework to take Singapore funds industry to new level. Investors Risk Profile. A new type of entity - the Variable Capital Company - will allow funds to both manage from and domicile in Singapore.

Heliconia also invests directly into Singapore-focused Private Equity funds. The portfolios top sector exposures include 2562 in industrials 2092 in healthcare and 1880 in information technology. The Fund aims to achieve capital growth over the medium- to long-term period by investing in a portfolio of.

While green loans have not historically been associated with fund finance this has become an area of interest for lenders and borrowers alike since ING Bank announced that it had introduced the worlds first sustainability improvement fund financing for a Singapore-based private equity fund Quadria Capital in October 2019. Where the public fund is a company or VCC incorporated and tax resident in Singapore the public fund being a Singapore-resident company or VCC can pay tax-exempt one-tier dividends which are exempt from Singapore income tax in the hands of its shareholders regardless of their tax residence status.

Sundaram Bluechip Fund Nfo Growth And Value Largecap Play Without Sector Bias Fund Small Cap Stocks Selling Covered Calls

How To Get Knowledge Of Investment Investing How To Get Best Investments

Savings Investment Tips 10 Points On Public Provident Fund Ppf Investment What Every Indian Investment Tips Savings And Investment Public Provident Fund

Tiger Global Management Newsletter Finnotes Org Management Investing Global

2020 An Inflection Point For Singapore S Equity Markets Economy By Shiwen Yap Venture Views Medium

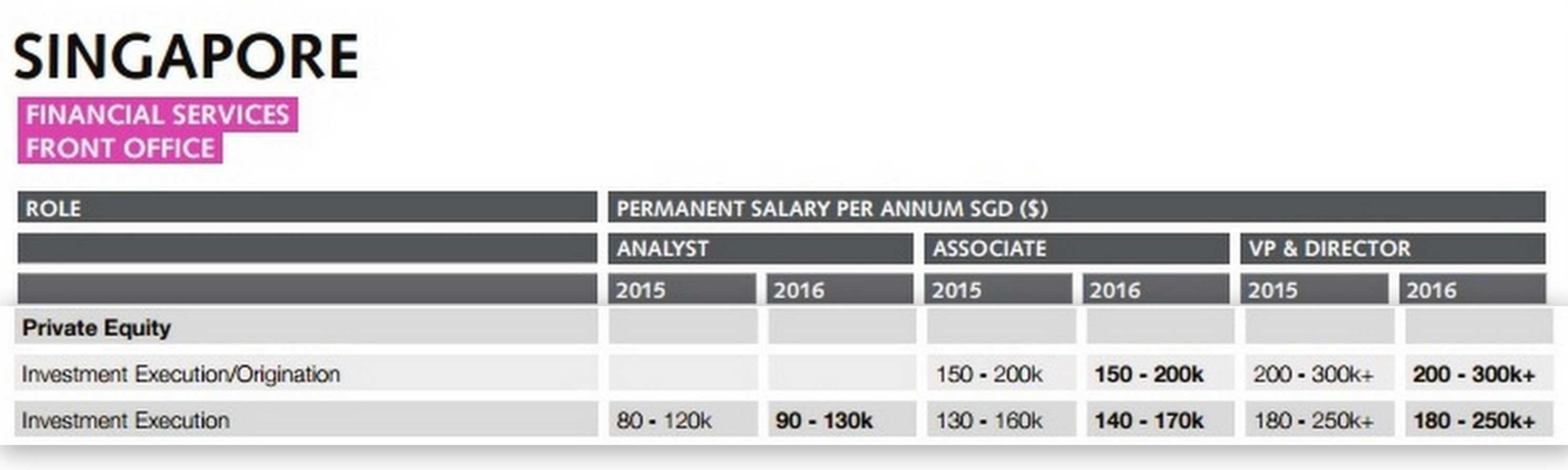

Private Equity In Singapore Top Firms List Salary Jobs

Crystal Fund Raising Commemorative The Corporate Presence Fund Fundraising Commemoration

Venturebeat Com Ranks Dati Digital Arts Media Network S Crowdfunding Venture Trucrowd In The Top 10 Equity Crowdfunding Crowdfunding Digital Art

Luxury Hedge Fund Office Space In Singapore By Elliot James Industrial Interior Office Renovation Industrial Office Design

Qfii Investors Conduct Their First Margin Trading Short Selling Deals In China Financial News Chinese Stocks Investors

Stephane Pizzo Is The Founder And Managing Partner Of Lotus Peak Capital Pte Ltd In Singapore He Has Over 20 Year Portfolio Management Hedge Fund Manager Fund

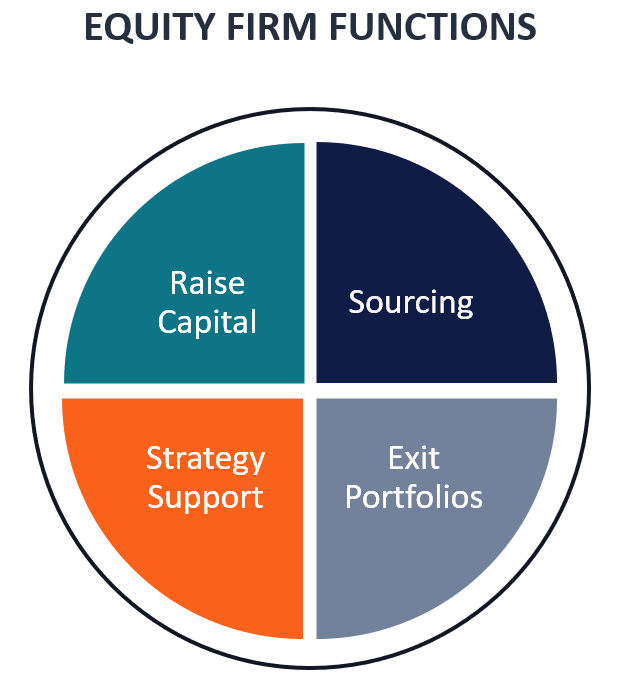

Equity Firm Overview Functions And Roles Of Pe Firms

Key Benefits Of Investing In The Stock Market Stock Market Investing Stock Advice

Fund Strategy Operations Consulting Bcg

Aging Equities Selling Stocks For The Long Term Selling Stock Equity Aging