7 years back simulation of all investment into EPF approved unit trust funds. KUALA LUMPUR 28 February 2018.

Pin On Central Government Employees News

For the 20182019 period out of 367 funds approved under the EPF MIS 268 funds from 22.

Revised epf approved funds effective 1. The amount will be set as the minimum target for EPF savings when members turn 55 years old. Rules 21 6142 6212 and 83 3. Existing operators are management companies which were managing SFC-authorised funds as at 1 January 2019 and trustees and custodians of SFC-authorised funds at that date.

Employee Provident Fund EPF refers to the scheme which provides monetary benefits to the salaried class people upon retirementIt is governed by the Employees Provident Funds and Miscellaneous Provisions Act 1952 EPF MP Act 1952. New Revision in EPF Limit. Page 1 of 3 FREQUENTLY ASKED QUESTIONS Reduction in statutory rate of EPF contribution from 12 to 10 Q1.

HRD3 22012SPF463 dated 31052021. Revised EPF approved funds effective 1 Sept 2010. Effective 1 September 2010 there are 223 unit trust funds approved under the EPF Members Investment Scheme EPF-MIS.

08 JUL 2020 429 PM by PIB Delhi. The EPF agency has listed as of March 2017 over 20 fund management institutions to manage unit trust funds under their investment scheme. This article is sponsored by Securities Commission Malaysia under its InvestSmart initiative.

Malaysian mutual funds with offshore exposure are now being approved for EPF members investment scheme. The new rules will take effect on 1 March 2016. DEFINITIONS In these RULES unless inconsistent with the context.

At this particular meeting a major decision was taken pertaining to the EPFO. It is applicable to every establishment which employs 20 or more. Written by Emmanuel Surendra.

The Employees Provident Fund EPF has released its Annual Qualifying List of Fund Management Institutions FMIs and unit trust funds under the EPF Members Investment Scheme EPF MIS effective today. These Revised Rules are effective from 01 March 2019 MOMENTUM RETIREMENT ANNUITY FUND. Under the FEM funds must meet the set.

In summary from 1 March 2016 the deduction cap for retirement fund contributions increases to 275 of the greater of remuneration or taxable income. Momentum Retirement Annuity Fund Revised Rules 1. The Employees Provident Fund EPF today published the List of Fund Management Institutions FMIs and unit trust funds that qualify for offering under the EPF Members Investment Scheme EPF MIS effective from 1 March 2018 until 28 February 2019.

Members may choose from the list of approved funds which include bonds equities money markets and balanced mixed unit trust funds to invest in. A 12-month transition period from 1 January 2019 applies for existing funds and operators to comply with the revised Hong Kong Code on Unit Trusts. Revised rate of interest - with regard to Staff Provident Fund in EPFO.

EPFEPS contribution is reduced and Rs200- less is deducted from hisher wages. In a statement today to announce the EPFs revised list of unit trust funds for the 20192020 period the pension fund said that during the 20182019 period 280 funds qualified for offering. Is the 10 rate of contribution applicable to establishments which get.

Types of Investment Schemes Available. The Union Cabinet chaired by the Prime Minister Shri Narendra Modi today has given its approval for extending the contribution both 12 employees share and 12 employers share under Employees Provident Fund totaling 24 for another 3 months from June to August 2020 as part of the package announced by the Government. This is a much higher percentage in comparison to when it was Rs6500.

The Act extends to the whole of India except the State of Jammu and Kashmir. The limit of the Employees Provident Fund Scheme was changed from Rs6500 to Rs15000. The list of EPF approved funds is updated upon conducting the fund evaluation exercise based on EPF-MIS fund evaluation methodology FEM.

APPROVED PENSION FUND and APPROVED PROVIDENT FUND. 7 years of unit trust fund performance data with specific annual return from 2012 to 2018. Medical Advance without documentation in cases of emergency hospitalization on account of serious life threatening illnesses including Covid - CIRCULAR WITHDRAWN - Revised Circular at Sl.

For the 20192020 period a total of 382 funds were approved under the EPF MIS nonetheless only 282 funds including 9 new funds from 19 FMIs qualified for offeringThis is a marginal increase of 07 per cent from the same period last year. This rate applies to the aggregate of contributions made to an individuals pension provident and RA funds. Analysis of fund performance for the following categories equity-conventional funds equity-islamic funds mixed assets-conventional funds mixed assets-islamic funds bond funds and money market funds.

20 rows KUALA LUMPUR 1 April 2020. What is revised rate of EPF contribution announced by the Central Govt. This is a marginal increase of 07 from the same period last year.

Members are reminded that investments via the EPF MIS are on voluntary basis and. A minimum pension of Rs1000 was also approved. Effective 1 January 2017 the Employees Provident Fund EPF has revised the quantum for basic savings from RM196800 to RM228000.

2112 the winding up of that fund or 2113 a transfer of business from one employer to another in terms of section 197 of the Labour Relations Act. 211 a member of an APPROVED PROVIDENT FUND whose membership of that fund has ended because of 2111 his resignation retrenchment or dismissal from employment. For the 20202021 period a total of 376 funds from 20 FMIs were approved under the EPF MIS of which only 280 funds are qualified to be.

Starting Aug 1 2016 EPF members can invest in unit trust funds that are fully focused on investing overseas as long as they are EPF approved funds as it has removed its 30 foreign fund exposure cap on investments undertaken by members.

Epf Subscribers To Get 8 5 Return For Fy21 Too The Financial Express

New Pf Tax Rules Faq Will I Need To Pay Income Tax On My Epf Interest From April

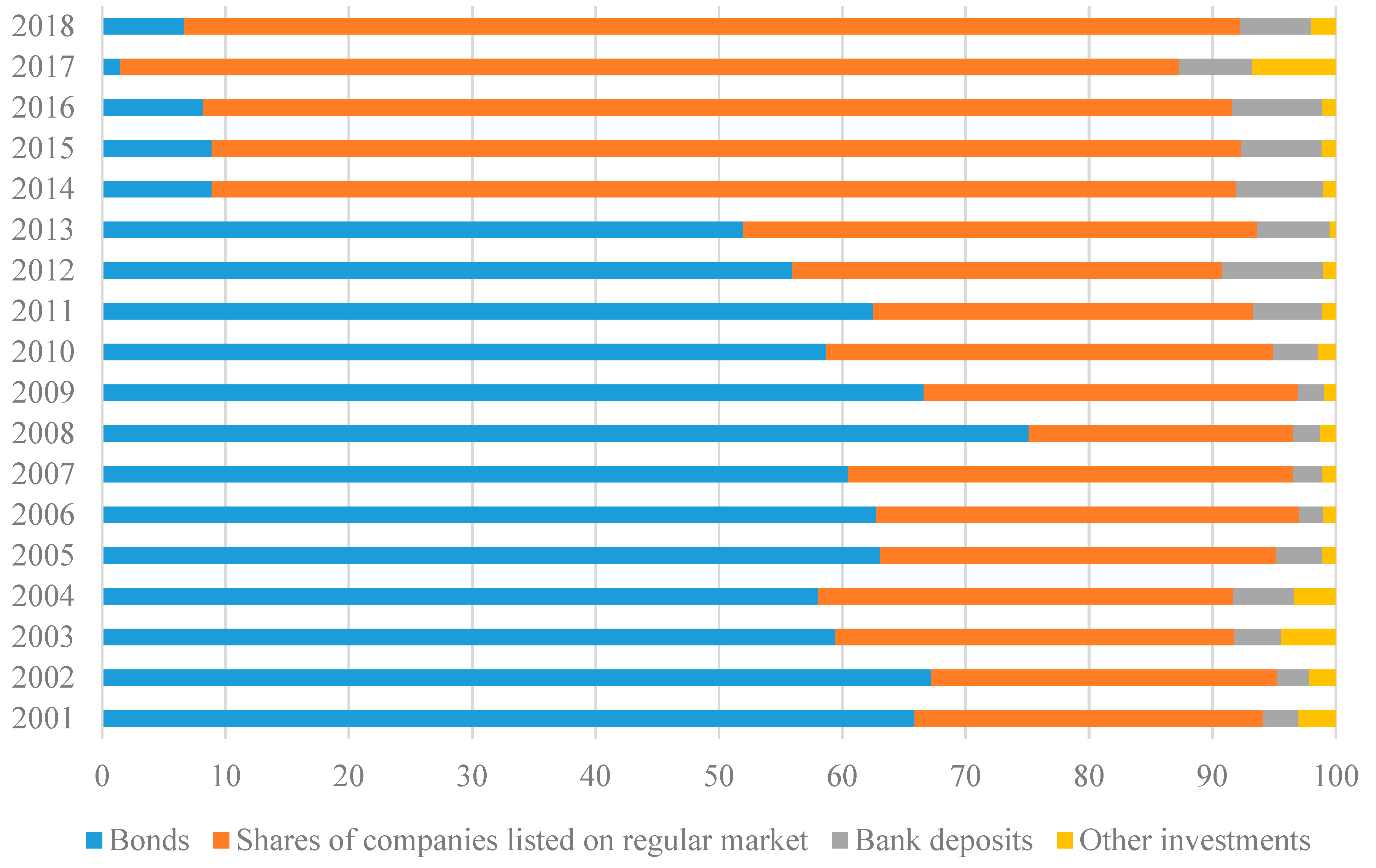

Risks Free Full Text Pension Fund Management Investment Performance And Herding In The Context Of Regulatory Changes New Evidence From The Polish Pension System Html

Comparison Of Axis Bank And Sbi Personal Loan Interest Rates Loan Interest Rates Finance Investment Personal Loans

Eastspring Epf Members Investment Scheme Flip Ebook Pages 1 4 Anyflip Anyflip

Negative Bond Yields Manulife Investment Management

How To View Epf Passbook And Track Contributions Interest Transfer Withdrawal

Epf Subscribers To Get 8 5 Return For Fy21 Too The Financial Express

Income Tax Ppt Revised Income Tax Income Tax

Limited Liability Partnership Registration Limited Liability Partnership Liability Partnership

What Are The Documentation Requirements Of Iso 9001 Consumer Awareness Knowledge Quotes Company Letterhead

A Bank Uses The Terms Ledger Balance And Available Balance To Specify The Position Of Funds In An Account Ledger Balan Finding Yourself How To Know Positivity

Dearness Allowance Hiked By 4 For Central Government Employees Dearness Allowance Growing Wealth Money Cant Buy Happiness